Net Burn

Last updated: May 15, 2025

What is Net Burn?

Net Burn, often referred to as Burn Rate, is the amount a company is losing per month as they burn through their cash reserves. It occurs when a company’s operating costs are higher than their revenue. A company that is profitable and generating cash has a "negative Net Burn".

Net Burn Formula

How to calculate Net Burn

Using the first method, if a company is spending $250,000 per month to keep the doors open and generating $100,000 in revenue, Net Burn would be: Net Burn = $250,000 - $100,000 = $150,000

Start tracking your Net Burn data

Use Klipfolio PowerMetrics, our free analytics tool, to monitor your data. Choose one of the following available services to start tracking your Net Burn instantly.

Net Burn benchmarks

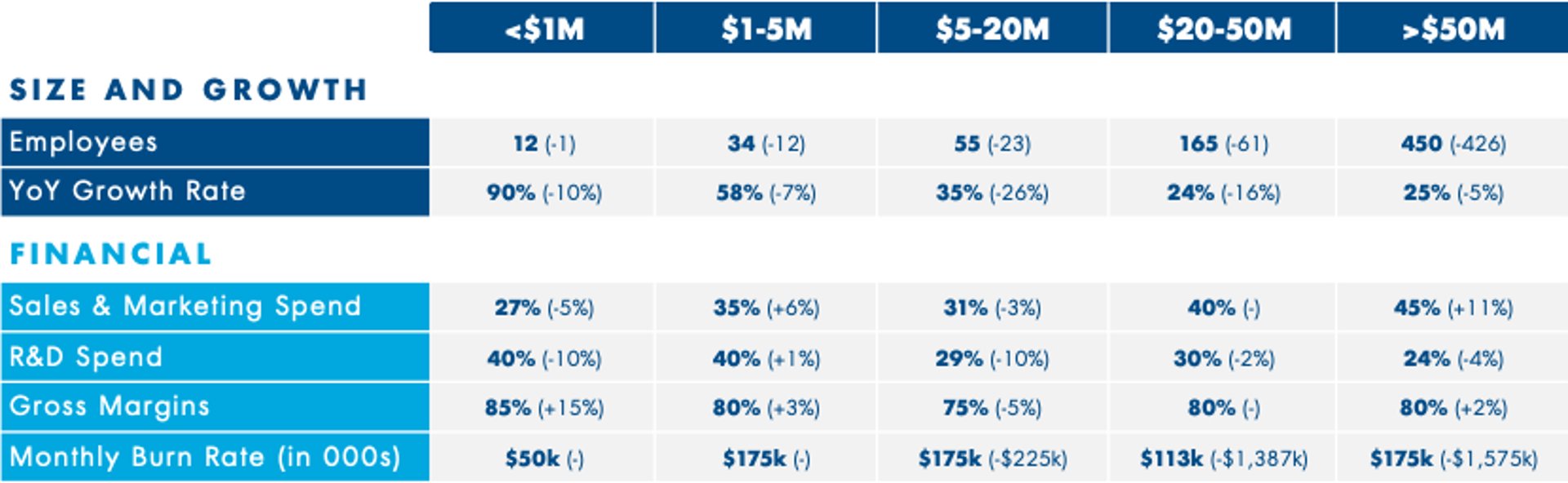

Financial Metrics by ARR (2023 vs 2022)

How to visualize Net Burn?

Use a summary chart to visualize your Net Burn data and compare it to a previous time period.

Net Burn visualization example

Summary Chart

Net Burn

Chart

Measuring Net BurnMore about Net Burn

Net Burn rate is particularly important for startups because it helps measure how quickly they are burning through their available capital in relation to their revenue. In SaaS companies, burn rate and revenue are typically measured month to month. Executives and investors use Net Burn to understand the company’s runway, or how long they have before they run out of money.

There are no hard and fast benchmarks for how fast a startup should be burning through invested cash. Venture Capitalists want to see that the money they’ve invested is being used to fund growth. However, companies that spend cash too quickly risk running out of it. In such cases, a fast growing company, that appears to be approaching profitability, could be at risk of going under. That said, when companies are in a conscious growth period, they may be burning cash faster as part of the plan to acquire customers quickly.

Businesses want their Net Burn rate to be low so that they can maintain their business for a long time before needing to secure another round of funding and to avoid bankruptcy. One way to do this is by keeping expenses low. If expenses increase and sales decrease then the Net Burn rate will increase quickly and the company’s runway will shorten.

There are two common methods for measuring Net Burn: By subtracting Gross Margin (Revenue minus Cost of Goods Sold) from Operating Expenses or by subtracting your ending cash balance from your starting cash balance for any given period.