Cash Conversion Score (CCS)

Last updated: Mar 17, 2025

What is Cash Conversion Score?

Cash Conversion Score is used by investors to measure the return on invested capital for startups. It is calculated by dividing current ARR by the difference between total raised capital and cash on hand. Essentially, this metric gives the return on each dollar invested in a company.

Cash Conversion Score Formula

How to calculate Cash Conversion Score

Say a company has generated ARR of $9 million by the end of the year, with $11 million capital raised and $3 million cash at hand. In this scenario, the company's Cash Conversion Score would be 1.1, often denoted as 1.1x meaning that the company saw a return of $1.1 dollars for each dollar invested.

Start tracking your Cash Conversion Score data

Use Klipfolio PowerMetrics, our free analytics tool, to monitor your data.

Get PowerMetrics FreeWhat is a good Cash Conversion Score benchmark?

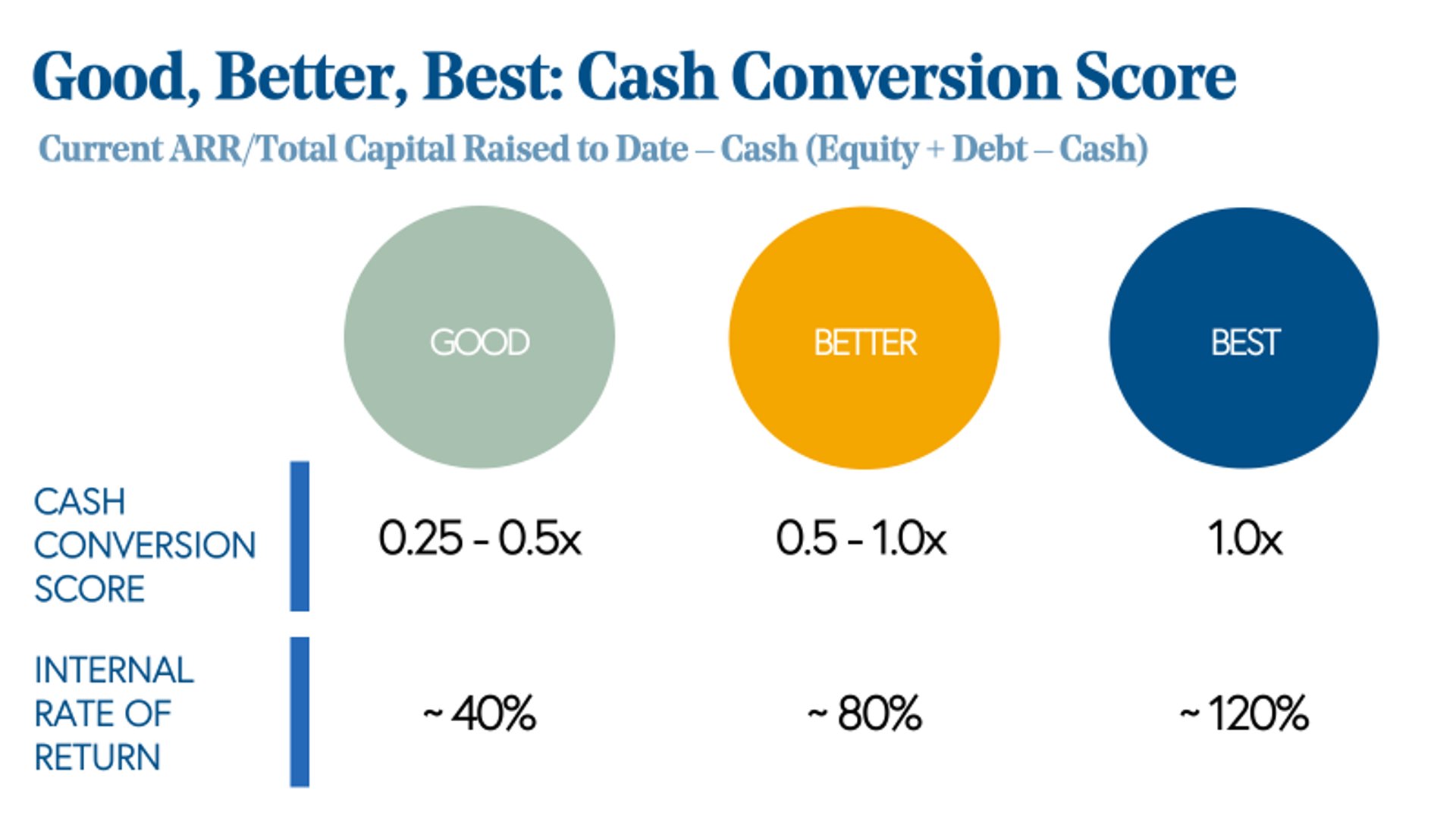

Bessemer provides guidance around benchmarks for CCS: Good: 0.25-0.5x Better: 0.5-1x Best: 1x+

Cash Conversion Score benchmarks

Cash Conversion Score Benchmarks

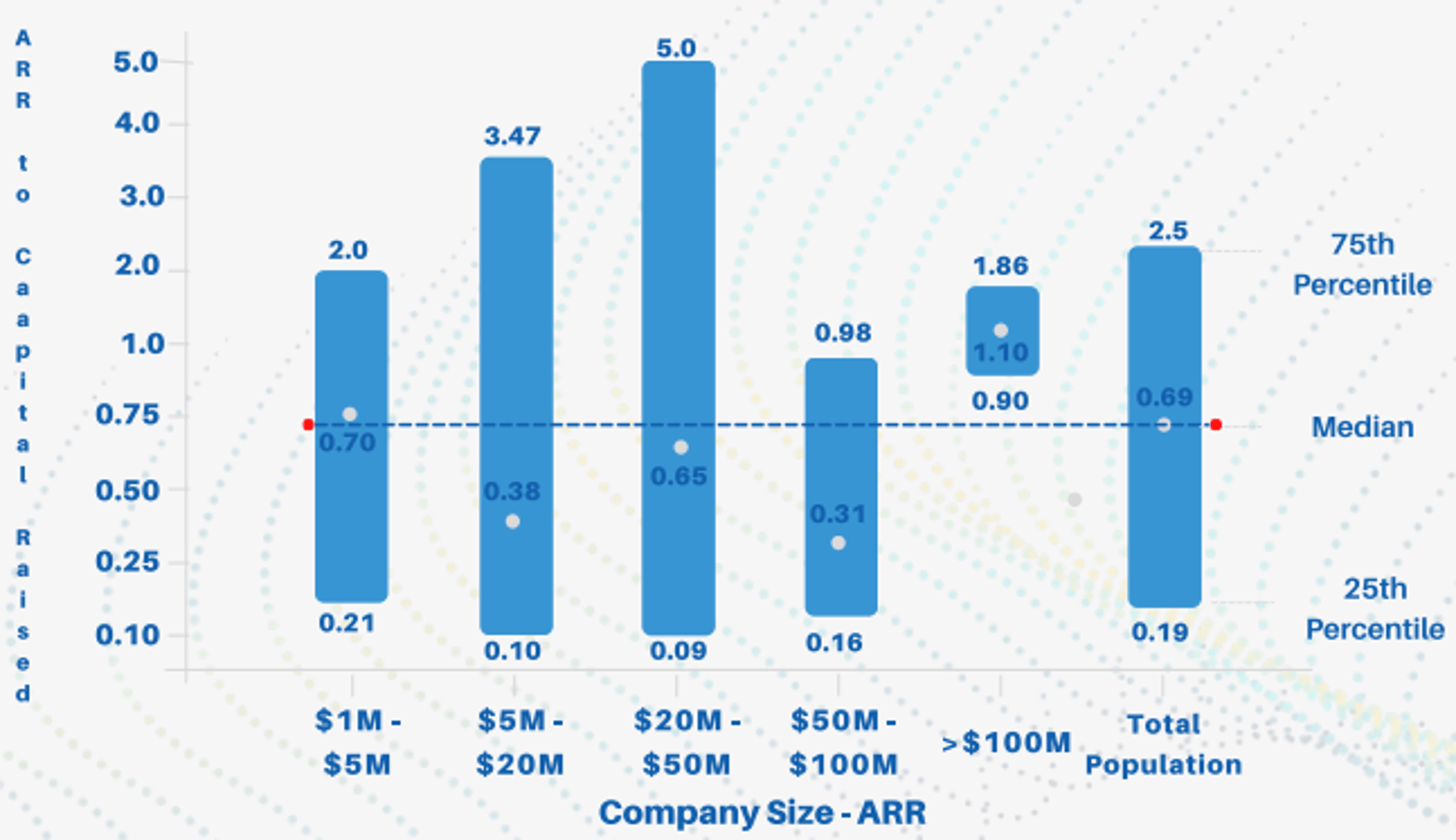

ARR to Capital Raised Ratio

How to visualize Cash Conversion Score?

The best approach to visualizing Cash Conversion Score is through a summary chart. You can then compare the current value to a previous time period.

Cash Conversion Score visualization example

Summary Chart

Cash Conversion Score

Chart

Measuring Cash Conversion ScoreMore about Cash Conversion Score

Originally founded by Bessemer Venture Partners, Cash Conversion Score (CCS) was created to provide a measure of return on invested capital for cloud businesses. It is a helpful indicator for value creation and also used operationally, for founders and management teams to understand their efficiency in turning capital into Annual Recurring Revenue (ARR). It is impossible to have a high CCS without strong product/market fit and a scalable sales and marketing model.

Cash Conversion Score is calculated by dividing the current ARR by the difference between Total Capital Raised to Date and Cash on Hand, where Total Capital Raised to Date = Equity + Debt.

Recommended resources related to Cash Conversion Score

Here's an article from the founders of this metric.Contributor

Podcast Episode