CAC Payback Period

Last updated: Mar 18, 2024

What is CAC Payback Period?

CAC Payback Period is the time it takes for a company to earn back their customer acquisition costs. The value depends on how high the Customer Acquisition Cost (CAC) is and how much a customer contributes in revenue each month or each year.

CAC Payback Period Formula

How to calculate CAC Payback Period

Company A sells B2B software, which generally has a three-month sales cycle. Sales and Marketing expenses from Q1 amounted to $1.2M. Net New MRR achieved in Q2 amounted to $275K. This company operates with a 75% Gross Margin. The calculation for CAC Payback period = $1.2M sales and marketing expenses offset by three months / ($275 Net New MRR X 75% Gross Margin) = 5.8 months. Company B, with a volume-based PLG go-to-market, spends on average of $400 in Sales and Marketing to acquire a new customer. The average new customer generates MRR of $25 or ARR of $300 ($25 MRR * 12 months). This company operates with a Gross Margin of 80%. In this scenario, the CAC Payback Period is 15.96 months or 1.33 years given this calculation: CAC Payback: $400 / ($300 X 80%) = 1.7 years or 20 months.

Start tracking your CAC Payback Period data

Use Klipfolio PowerMetrics, our free analytics tool, to monitor your data.

Get PowerMetrics FreeWhat is a good CAC Payback Period benchmark?

According to OpenView, the best in class CAC Payback periods in 2021 by funding stage are: 15mo. for Seed; 21mo. for Series A; 17mo. for Series B; 28mo. for Series C; 21mo. for Series D+; and 17mo. for public companies.

CAC Payback Period benchmarks

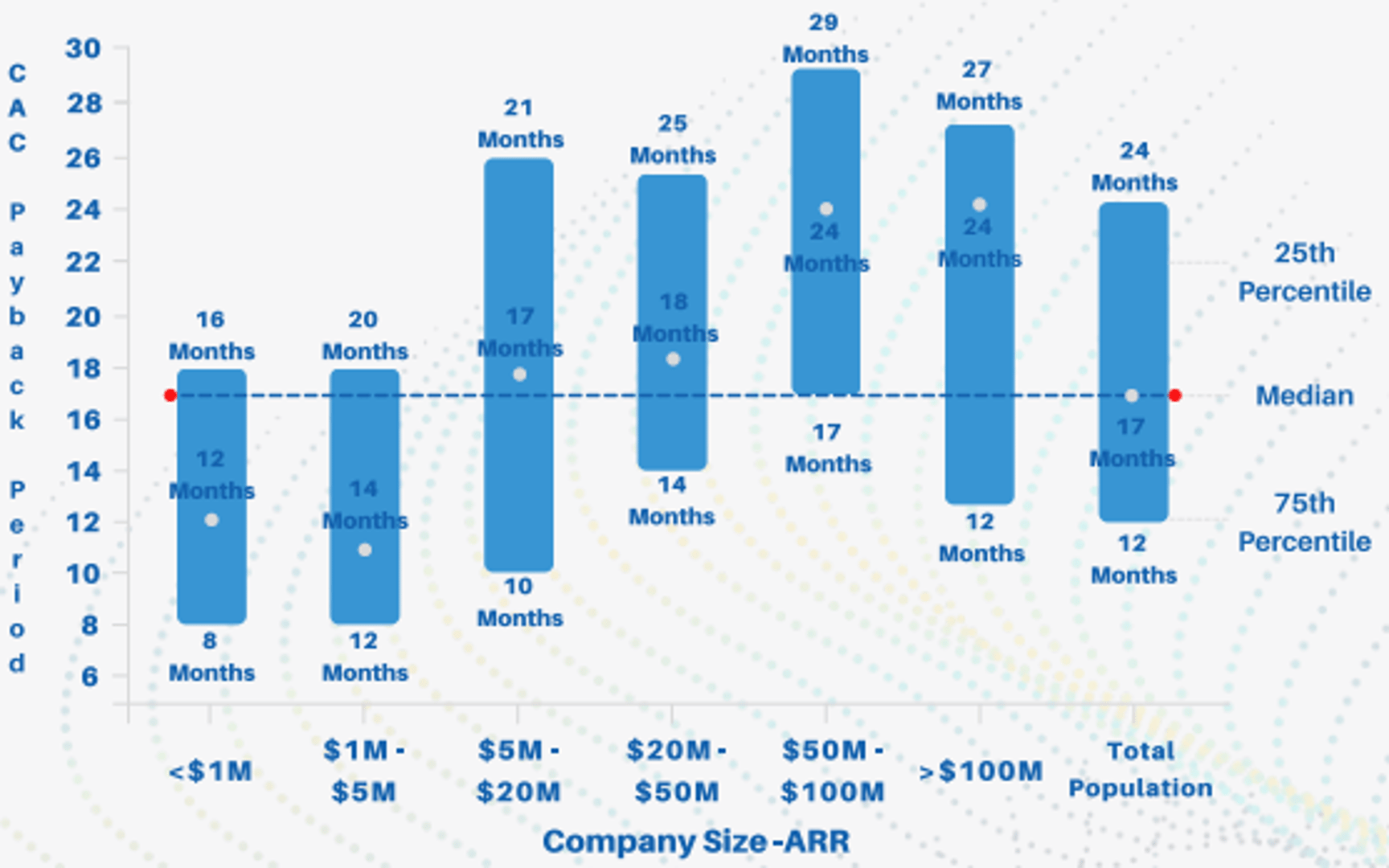

CAC Payback in months by ARR

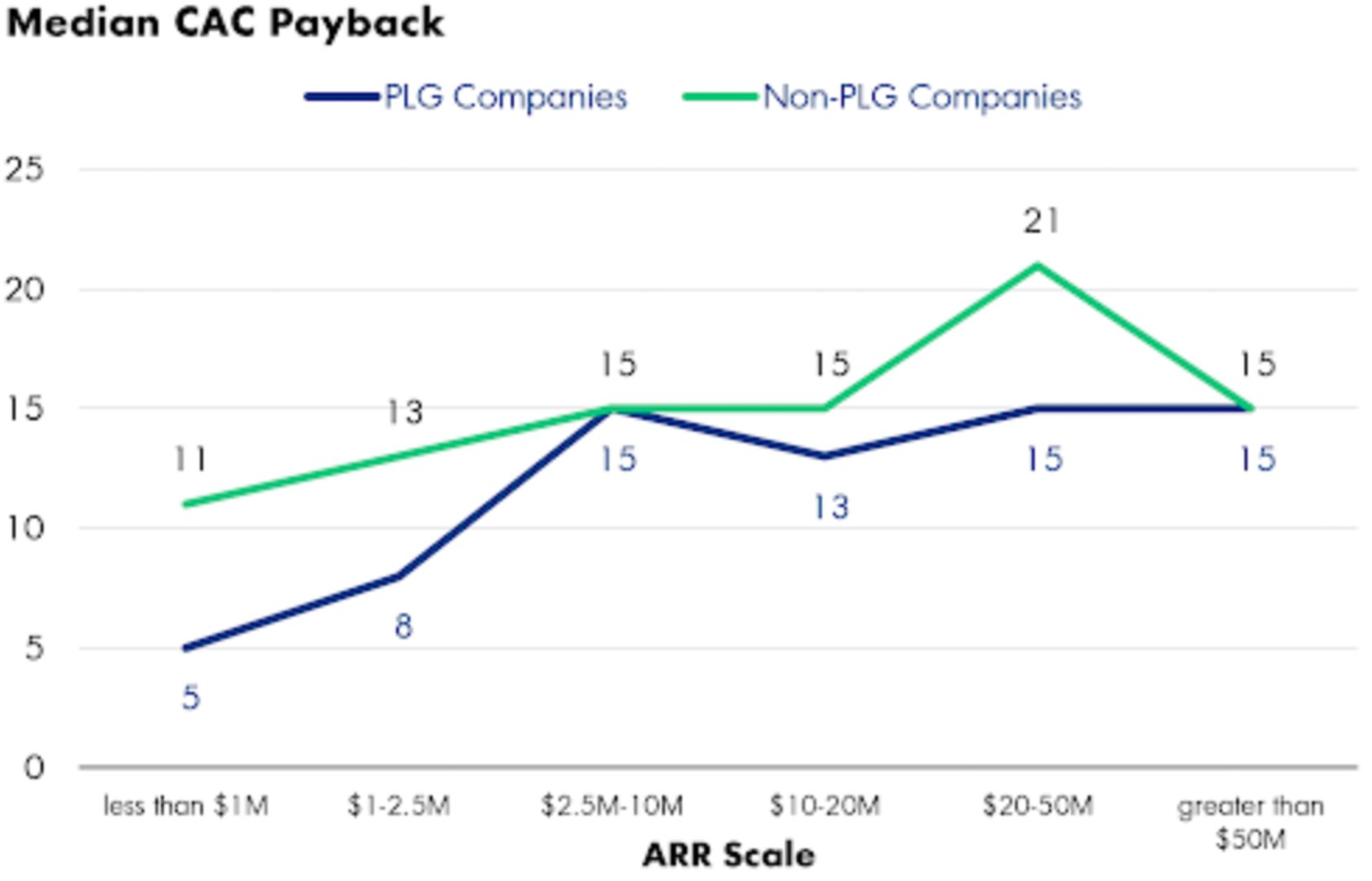

CAC Payback in months by ARR, by PLG vs Non-PLG

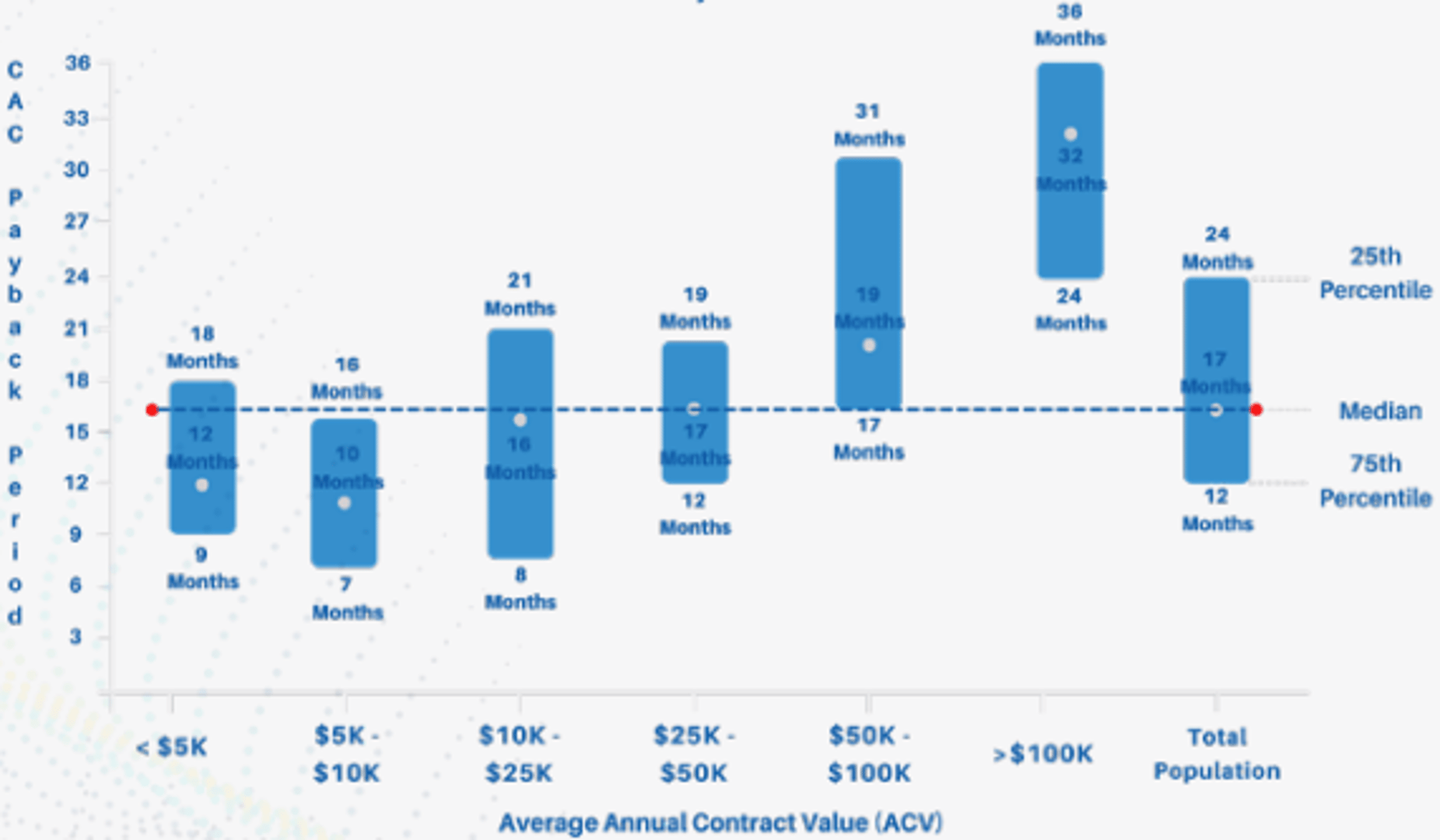

CAC Payback in months by ACV

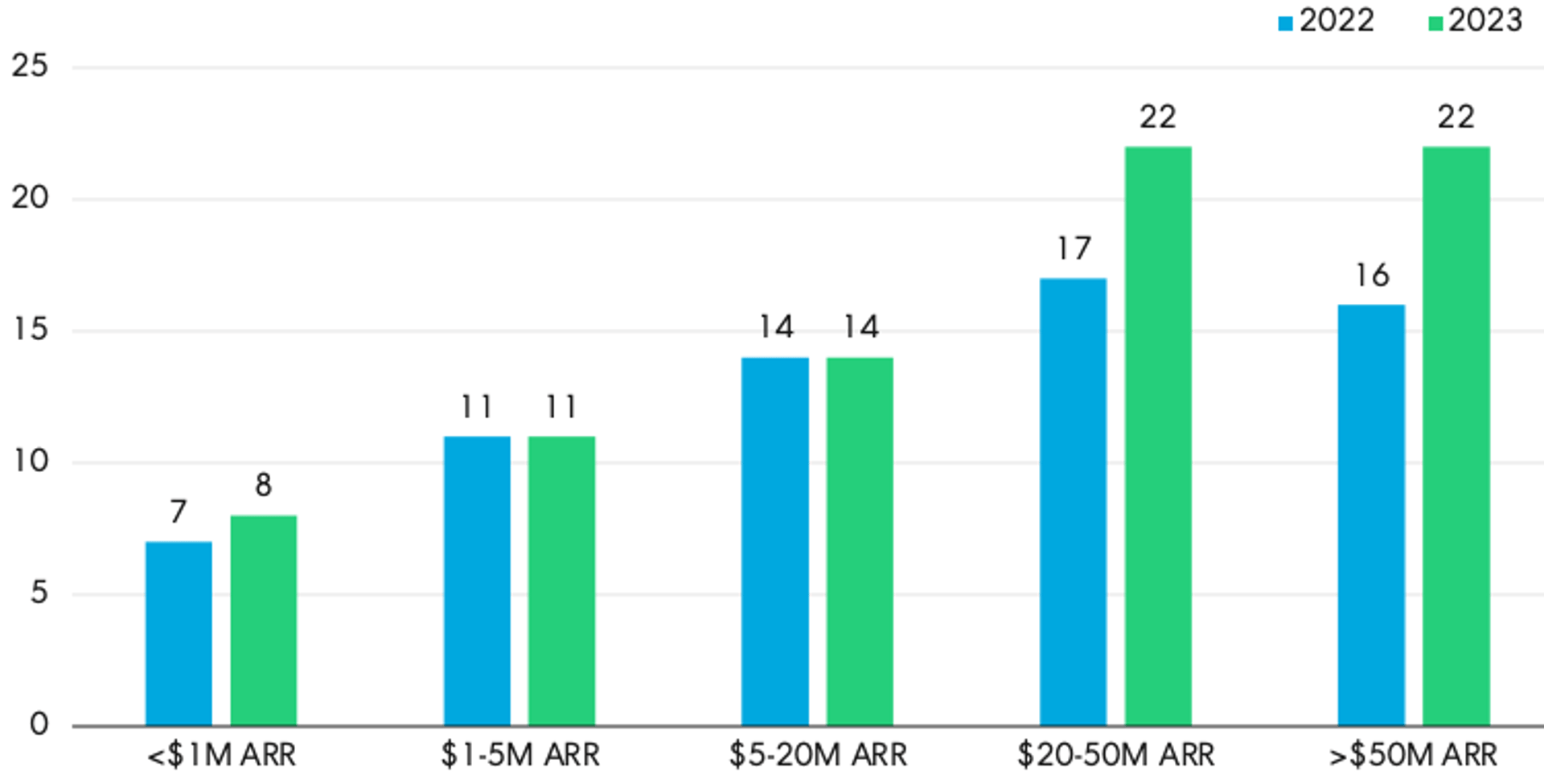

CAC Payback in months by ARR (2023 vs 2022)

How to visualize CAC Payback Period?

You can visualize CAC Payback Period best with a line chart, which shows changes in trends over time. Ideally, your chart should show a steady or upward trending CAC Payback Period.

CAC Payback Period visualization example

CAC Payback Period

Line Chart

CAC Payback Period

Chart

Measuring CAC Payback PeriodMore about CAC Payback Period

CAC Payback is the single best measure of the efficiency of your go-to-market engine. The shorter the payback period, the better the strategy. Generally speaking, SaaS startups aim to recover their Customer Acquisition Costs (CAC) in 15 to 18 months and high performing SaaS companies normally have a 5-7 month payback.

CAC Payback Period combines three fundamental metrics to help you understand earnings from your customers: Customer Acquisition Cost (CAC), the all-inclusive marketing and sales cost you spend in a period, new Monthly Recurring Revenue (MRR), that which is acquired from new customers in the period, and your overall Gross Margin percentage (GM%).

Note that CAC Payback Period does not factor in churn. It assumes that you will see a return on your customer acquisition cost during the lifetime of your customer (before they could, theoretically, churn). For this reason, it's important to also monitor your LTV:CAC Ratio. Customers who churn within the CAC Payback Period are costing you.

Understanding CAC Payback Period helps you decide how aggressive you should be when acquiring new customers on yearly or multi-year plans vs monthly plans (which typically have a higher churn rate). From a cash perspective, if, on average, it takes you 10 months to recover the cost to acquire a customer, and you are able to sell an annual "paid upfront" plan, then your payback period for that customer is 0 - or instantaneous. It's cash in the bank, that you will not need to finance via debt or equity.

Recommended resources related to CAC Payback Period

CAC Payback: What It Is, How to Calculate It and Why It Matters. By Sean Fanning, OpenView.Contributor